Isn’t it too bad your grandfather only left you money?

The contents of this Insight are generalised, and readers are urged to seek specific advice on matters and not rely solely on this text. © Vibha Vallabh, Ellora Private Office, December 2022

“Some people inherit fortune. Others are left huge tracts of land. But Booker Noe, of Bardstown, Kentucky was luckier than that. He inherited his grandfather Jim Beam’s talent for making bourbon. Today, Booker Noe carries the 200-year Beam family tradition of bourbon making with a dedication that could only be borne of outright love for the whisky that calls Kentucky home.” [1]

Booker Noe’s grandfather Jim Beam was a fourth-generation distiller, and part of the bourbon making family dynasty founded 130 years before by his great grandfather Jacob Beam.

Jim Beam nearly lost this family legacy through no fault of his own when the Great Depression coincided with Prohibition where many family distilleries were permanently closed. Instead of taking this step, Jim decided to temporarily close the family distillery and find other ways of earning a living. In the meantime, he rode out the storm waiting patiently for twelve years before Prohibition was lifted before he could go back to the distillery doing what he loved most and was talented at.

After Jim Beam died, as did the talent or so his family thought. For a while the family business consisted of just managing the brand and product with no further development. By accident, it was discovered that his grandson Booker Noe showed promise which the managers, that included fellow family members of the company, were willing to take a risk on. Throughout his childhood, Booker whilst at boarding school and not living too far away, spent some time with his granddaddy during his school holidays. Perhaps unintentionally learning and developing his own talent. It later transpired that Booker Noe inherited his grandfather Jim Beam’s love and talent for making whiskey, carrying on the 200-year Beam family tradition of bourbon making. As well as having this extraordinary talent, he was also gifted at managing the teams at the various distilleries. They were devoted to the man and he to them and to bourdon making, furthering the family business and fortune.

The past and the present brings plenty of examples of how great family fortunes are made, sustained, or lost by successive generations. Perhaps they can serve as parables. As we will see, it is more than just the land and money that your grandfather left you. More importantly, it is also the ‘intangible assets’ that a family acquires and passes down generations that ensures the longevity of wealth across generations.

Whichever stage of growing your family’s wealth you find yourself at, planning for its protection and giving it the optimal conditions for future growth will ensure its survival for the long-term betterment of your family both present and future.

Once Upon a Time

A fact that is often overlooked and even taken for granted in a world of instant gratification and vilification of ‘the rich’, is that the origins of family wealth always began from humble beginnings. We are here now because of those who paved the way before us. There is this slow evolutionary development or regression across generations depending how the lives of a family and its members played out and what was passed onto the next generation. Progress can either be measured by material tangible wealth and/or intangible such as talent, education, values, resilience, entrepreneurship, and work ethic.

At some point in time, there will come along a family member who will be referred to for convenience as the ‘original founder,’ who possesses extraordinary talent, who is innovative and entrepreneurial, but also has the ability of using the external environment to their advantage. Defeating forces of market competition and making the most of external weaknesses. They were opportunistic, could build monopolies with little regulation, work the imperfections of markets, and visualise key trends in the economy before others. They also took advantage of legal manoeuvring or exercised political influence. Time and place mattered as well as their talent and business acumen.

If this perfect combination exists, it propels forward this evolutionary progress of a family’s wealth, resulting in extraordinary prosperity, sometimes even taking a few generations before experiencing real material success.

For generations thereafter, even if this perfect combination died with the original founder- if a family can develop business acumen, keep on top of ever-changing external factors, and adapt themselves accordingly, making them work in their favour, as well as investing in family intangible assets - they will be able to build upon the family wealth. Continuing the evolutionary progress all be it incrementally in comparison to the original founder, but none the less for the betterment of future generations.

History has also shown the alternative scenario, where great wealth was accumulated by the original founders during the gilded age who were not only talented and entrepreneurial, but also worked an external environment that was extremely advantageous. Unfortunately, this great wealth shrank with time. Having succumbed to lavish spending to maintain a lifestyle like their peers, preference for indulgence, and short-term gratification of enjoyment with as little work as possible. No investment was made in those intangible assets which may have at least preserved the wealth rather than dissipated it.

Keeping It in the Family

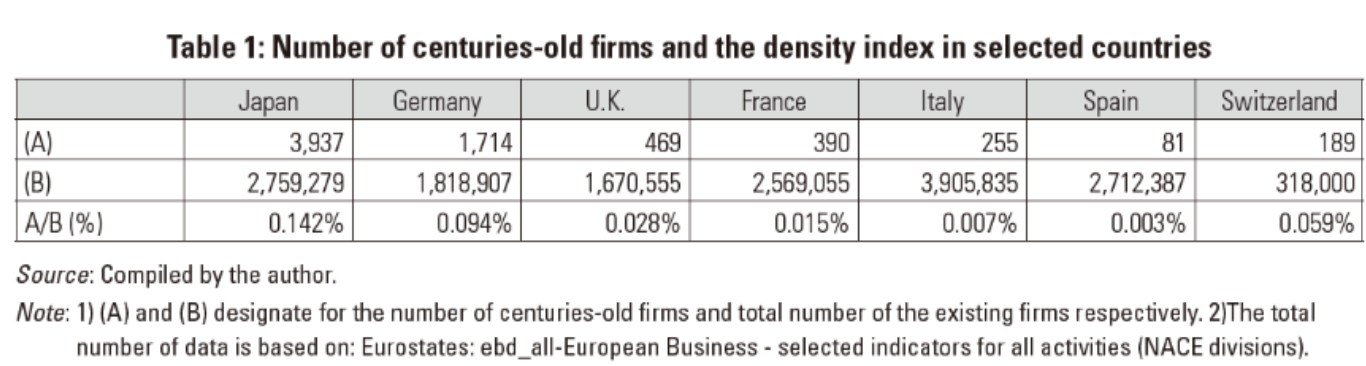

Some of the oldest continuous recorded family firms can be found in Switzerland, Italy, and Japan. The following data is from a paper written by Toshio Goto. [2]

Gotto made the following observations:

(i) It is conservatively estimated that family business makes up between 65% and 80% of all existing firms in the world; (ii) family business unanimously takes a majority of the total number of the business institutions, employment, gross domestic product (GDP), as well as the value added; (iii) In the United States for example, 35% of the S&P firms (excluding financial institutions) are family business; (iv) family business outperforms other type of firms.

He also found that 20 of the oldest firms in different countries and industries had common characteristics: family unity, the business comes first, a product connected to the basic needs, the role of primogeniture, influence of women, a commitment to continue a legacy, adoption to insure succession, community/customer relations, conflict management, written plans, and governance of family enterprise. Top values addressed by old family firms are honesty, creditability, obeying the law, quality, and industriousness.

Family as a Resource

There have been successful families that have been able to maintain this equilibrium of growing capital as well as intangible assets, increasing wealth through generations. Outside of established aristocracy, the Rothschild and Peugeot families are perhaps the few well known documented extraordinary families where wealth has successfully survived successive generations.

The Rothschild Family

Two hundred years ago, Mayer Amschel Rothschild was raised in a ghetto in Frankfurt whose ancestors were small merchants. He was sent away to be a rabbi, but when both parents died so did his studies. Some relations secured him an apprenticeship in the Jewish banking house of Oppenheimer in Hanover, a region that tolerated Jews. Jewish traders had offered each other support which the gentile world had excluded them from.

Mayer married Gutele Schnapper and returned home to a less hospitable place where Jews were treated badly. He kept a small store, raising his family including five sons. All Mayer’s work was a dynastic investment in his sons. The family business was agile, changing with recognised opportunities, a talent which Mayer passed onto his sons. Initially trading in second hand goods turned into selling coins, medals, and heirlooms. Then the House at Saucepan a Wechselstube became a place where the currency of the Germanies could be exchanged with the utmost discretion. The biggest break came probably because of this practise of discretion, when Mayer was appointed Oberhofagent (Superior Court Agent) to the German Landgraveses of Hesse- Kassel, Free City of Frankfurt where his two elder sons could now be called Hessian Pay Office agents. All operations were carried out by the Rothschild family in discretion, always maintaining neutrality no matter who they were dealing with.

Real wealth only came when he sent his five sons out into the world where they established an international banking business in London, Paris, Frankfurt, Vienna, and Naples. “They were part of the invisible politics of the 20th Century, they were banker to empires and continents to all the principal European countries, to Eurasia Russia, the Americas and to the Indies. Upon the Rothschild’s vaults converged the credit of the Western World.”[3]

In 1800, Mayer entered a partnership with his eldest two sons. He established rules which became the family constitution. All key post were manned by family members which remains to this day. The female line was kept out of family business with only males and their spouses included. On marriage, the boys must choose other Rothschilds or at least other Jews whereas the girls were sometimes allowed Christian aristocrats.

Whilst individual brilliance may have been accomplished by each of his sons, they consulted and complimented each other. Frederic Morton describes them as being practical and self-aware. More importantly they learned the importance of supporting one another in their restricted Judgengasse life. “Rothschild style is an expression of luxury not a distraction from it. In the midst of frank splendour sits a wholesome Jewish appreciation of the utilitarian.”[4]

Even in death Mayer emphasised the unity of the house. His Will did not mention assets, but that continuity and privacy of the fortune must be maintained. "I would request that the executors of the Will as well as any relations in Frankfurt or London unnamed, confine their efforts simply and solely to the execution of this my Testament and, since it does not pertain to their office at all, not to ask for any further information, or for the production of any books or accounts.”[5]

Mayer’s eldest son Anselm's testament written in 1874 was similar to the first patriarch's, "I charge all my dear children to live constantly in perfect harmony, not to allow family ties to loosen, to avoid all disputes and unpleasantness and legal actions; to exercise forbearance and tolerance to one another and not to let themselves be carried away by angry passions;... let my children follow the example of their splendid grandparents; for these qualities have always insured the happiness and prosperity of the whole Rothschild family, and may my dear children never become unmindful of this family spirit. In accordance with the exhortations of my father, the grandfather who so sincerely loved them.... may they and their descendants remain constantly true to their Jewish faith."[6]

The wealth of the family took a battering after both wars but has survived to this day by adapting to change, recognising opportunity, and keeping it in the family. Industriousness is how the structure of the business is described. Daily meetings are held where data is presented which must be understood, absorbed, processed into decisions by the head of the family. Businesses are not run by hired managers or agents.[7]

The Peugeot Family

The Peugeot family can be traced back to the 15th and 16th century. To start with, they were peasants and occasionally soldiers. Later descendants had industrial and commercial occupations. Then in the 18th century, Jean Jacques Peugeot married Suzanne Mettetal, who came with a family flour mill. Another descendant, Jean Pierre went into textile manufacturing and oil making, setting mills to breaking linen and hemp, and battery to beating grains. During the revolutionary regime he brought a couple of forests. He had the foresight to know that wood would be valuable commodity and in 1802 started a paper mill.

When he died in 1814, he left his four sons a diversified industrial patrimony. Two of those sons married well so prospered further. They went into cotton printing which was profitable and protected by the state. Seeing what was occurring in industrious Britain, they saw bigger opportunities in machines and its ability to spin cotton and other yarn.

Unfortunately, the brothers died of typhus and their children showed no inclination to take over, so cousins stepped in. Under Jean -Pierre Peugeot 1768- 1852 the family saw the most growth opportunities in the company.

Rober F Peugeot (1873- 1945) son of Jean-Pierre Peugeot, during this lifetime, wanted to avoid the dispersal of the family fortune and so with concerted effort to avoid this predicament kept a close eye on everything. All workers were treated generously, creating a sense of inclusivity to non-family members as would be extended to family members and he encouraged them to save. "In a sense we see here a company with socialist ideals competing successfully in highly competitive, highly capitalist market. To this day the company has low turnover rates." [8]

Like the Rothschild he also instituted family rules: [9]

Shares could only be passed to sons, and like the Rothschild, never to daughters or sons-in-law. It would get around French forced heirship rules, by the company buying the women out.

Each shareholder will hold shares in custody rather than enjoying income. All family members had to reinvest earnings from the company in the company and have enough collateral income so they would have to work to make enough money to reinvest.

There was no stipulation that they had to work in the family firm, but if they were capable and wanted to work, they could count on united family support to maintain them in key posts.

All the sons would be given a place on the board of the family partnership. Their voting power would be partial to start with but would grow as they grew older and gained experience. It would grow faster for graduates of one of the grandes ecoles. The aim was to ensure a well-educated pool of descendants.

Executive managerial officers of the company were explicitly forbidden to engage in political activity other than local- no distractions, however attractive.

Unlike the Rothschild family, the Peugeot did not have enough family to continue to run the show. A similar predicament affecting families of wealth today. Instead, they employ outside executives who will be loyal to the organisation and not pose a threat to family control. Which is less likely to occur if the family is unified, preventing anyone from profiting from family discord. Unfortunately, the same could not be said of the Morgans, Ford, Agnellis and Fiat families.

Other Families

JP Morgan was highly talented. The business was so large to manage on his own that he appointed partners. Selecting them not based on status or birth, but on talent, education. A self-made man with good manners and right conduct impressed him the most. However, after JP’s death Jack Jr lacked leadership skills and was more into fine living, not giving him much time to managing the business. Jack’s children had no appetite for banking, so the house of Morgan went from a family dynasty to a partnership of strangers.

Later generations of the Ford Family, Angellis and Fiat brought outside managers to run their family firms. Because of lack of employee loyalty, power struggles ensued where personal ambition clashed with the wellbeing of the family and its business, better suited to the public company environment where profits and reward is the sole focus.

Other famous families such as Medici, Gucci, Rockefeller, Carnegie Vanderbilt, and Guggenheim all enjoyed great wealth initially which unfortunately could not be maintained by successive generations.

The stories of trials and tribulations and details of how this occurred may differ but the reason of why this happened is the same. Inattention and/or lack of ability to manage the family wealth.

Investing in Family Intangible Assets

Consider family intangible asset not in the traditional sense of patents, copyright, royalties, goodwill or trade name; but rather as still lacking physical substance, but without which the business of growing family capital cannot occur. They are different in so far as they would include such things as values, talent, ability, perseverance, emotional intelligence, determination, and resilience both at a family and individual level, gained from both formal and informal education. All requiring investment of time, money, and focused attention by older generations.

Much focus by the founder and second generation goes into building the family business or family enterprise of managed assets to accumulate capital, and little into family intangible assets, making families ill prepared for succession, often failing resulting in family wealth dissipating.

For success, family intangible assets are needed to sustain and grow actual capital. Both generate income and increase capital. You cannot have one without the other. They are in essence, interdependent on each other. A family needs capital to invest in its own intangible assets; and investment in intangible assets is required for growth of enterprise capital and income. If a family does not create capital to invest in family intangible assets, it will ultimately consume capital and we all know how that ends.

Intangible assets not only grow capital and income but also other areas. Emotional intelligence required to serve as trustee; entrepreneurial mindset to develop new business enterprise; patience to coach and mentor younger generation nurturing talent and ability so they can be put to best use; operational intelligence for efficiency; and fostering good reputation within the community.

The most successful families are those that are not satisfied in the status quo of inheriting wealth from the previous generation but are constantly maintaining and creating new enterprise capital which can only be achieved if the necessary investment has been made in the family intangible assets, serving as custodian of the family wealth during their lifetimes, maintaining a long-term view for future generations.

Education, Education, Education

Values

Success in families has traditionally been achieved where there is a values-based family and business, and continuous development of the next generation. “Gilded Age wealth creators were not very attuned to preparing their children for wealth or training them for their role. They had no idea that this was important or that it was a role that needed preparation. They were self-made and self-orientated and did not look to the future. They often worked at cross-purposes; they showered their children with the trappings of affluence to show their power and importance while at the same time expecting their children to make it on their own.”[10]

Family values and culture is not new in the East as families have always been dynastic often thinking beyond their own lifetimes. For centuries, each generation has focused on working hard and making sacrifices for successive generations in the hope that the family will be better off compared to them whether it be in terms of wealth, education, or both. The wellbeing of the family and collective always came first before independence and individualism as seen in the West. The oldest continuous family businesses that adopted values system (Japan Confucianism) compared to independence and individualism seem to survive better. “The families espoused a value system on Confucianism, a social-religious philosophy that prescribed family cooperation with established roles and respect for elders. The Confucian ethic is comparable to the Protestant ethic, which emerged a millennium later, prescribing principles and values for ethical family relations and social enterprise.”[11]

The Cadbury family were driven by their clear sense of purpose and priorities articulated and built around their Quaker identity which contributed to their success. “Simplicity, frugality (reinvesting most of their profits in the business for long term growth and innovation), solidarity, social equity. To their fellow Quakers, they provide finance, business advice and access to community networks, with strong belief in access to opportunities and social justice. Religious community was a sort of extended family.”[12]

With the East having a notably large diaspora worldwide and with the influence of technology and media, their children will invariably be influenced by Western values and culture; or have received some sort of education and gained work experience outside of their home country. They have been exposed to a culture of independence and individualism. When returning to the family business or home country, for wealth succession to be successful, the family may need to adapt by finding a balance between collectivism and family first with independence and individualism.

Family values and culture not only set out clearly a family’s expectation of each other; but also, how they should conduct business and themselves within the family and wider community. This is harder to replicate in a non-family business environment and probably accounts for why family businesses consistently outperform public corporations where the focus is only on profit. Credit Suisse have consistently observed that family and founder owned businesses tend to outperform the equity markets.[13]

Family and business governance is best if separated, but by sharing the same values should be able to interact and work well with each other more easily. These same family values and culture will naturally be reflected in the operation of the business or enterprise making it easier to manage the business, requiring less effort of adoption and resources compared to a public company and its employees.

It is only a matter of time before ESG becomes mainstream by law or regulation. Family businesses and enterprises that already implement values in their operations, should have less difficulty in making the transition compared to public companies.

With each generation, the family becomes bigger with additional branches. It is inevitable that values and goals may differ slightly from the original founder. Family values and culture should be robust enough to be sustained in times of change both good and bad and renewable with each generation; but also, must be attractive enough for family members to be incentivised enough to stay and grow the family business or enterprise; more importantly to develop the next generation possessing those same values and culture in mind. In large family businesses it is possible to create processes for this to occur as well as the ability to align diverse agendas and goals.

Being part of a family clan means that there are more opportunities to develop yourself as a person and at entrepreneurship which would not otherwise be available when working outside the family business.

To sustain family harmony, particularly where there are many branches, the family must work hard in building personal relationships, developing shared family values and identity, while at the same time motivating members to stay and contribute. Robert Peugeot would preside over family lunch every Sunday, attended by three sons and two daughters and their respective spouses and fourteen grandchildren discussing not family business but current events and accomplishments from school.

Sometimes there will be instances where some members of a family are unable to find consistency of values, may be disinterested or unable to work. A family must have an exit strategy in place should this occur, that will not only be beneficial for that member but also for the family and business.

What could these values look like? The detail may look different for each family and will depend on country of origin, existing cultural or religious values and practise. These values are unspoken and understood considered the norm in behaviour and thought. But there are some that are universal.

Dennis T Jaffe and his research team interviewed families that have stayed together over one hundred years sometimes up to six generations and continue to flourish. His research team found that the families around the world were universal in their desired values for successors:[14]

Generosity: Young people should give back to the community.

Respect: Young people should value people of all wealth and background.

Work Ethic and Skills: Young people should have the capability to earn their own money and to find work they care about and at which they can succeed.

Self Esteem: Young people must learn to find value in themselves independent of their wealth.

Financial Literacy: Young people should learn how to handle money.

Responsibility for Wealth: Young people should not be spoiled by affluence and should understand that wealth is a tool, not an end.

Frugality: Young people should exercise prudence in their spending.

Pride: Young people should appreciate the opportunity wealth offers.

Whilst every family they interviewed adopted different strategies, some were consistent.

Deep spiritual purpose: Where each is committed to the enhancement of each member with the goal of the entire family prospering. Adopting systems and practises that will enable it to achieve this goal. If the individual flourishes, so too will the family. The family as a unit is a powerful unit that can endure all storms.

Incentivisation: By the second generation, a family must create attractive family systems that are positively attractive, incentivising buy in by all members. The actions that these family members then take to make this realisation actionable.

Learning: All family members are thriving by a growing family learning system both at an individual and communal level, and sharing what they’re learning with each other, enhancing the family’s overall resilience.

Respect: The family can make extremely good strategic joint decisions of governing itself so to avoid poor social relations with each other which could potentially kill growth. Also having the ability to have positive relationships outside the family such as philanthropy and/or deal with attacks from outside the family.

Vision: A family’s ability to form a common generative vision that enables long term flourishing both at an individual and family level.

All strategies require a long-term commitment. How is this achieved? Dennis and his team found that families unlike public companies, were not looking for immediate profit or short-term gains, but rather look ahead to the next generation for the benefit for their children. Interviewed families “caution current family owners not to come to depend on an annual income from the enterprise (though in every family some family members ignore this, sometimes to their detriment). This perspective engenders patience as they develop the values, skills, and resources of each new generation to contribute to the growth and development of the enterprises. Without such patience and thoughtful preparation, success would be hard to sustain.”[15]

Identity

As well as values, also important is the identity of a child independent of the family and its wealth, status and recognition that comes with it. “The trappings of wealth are omnipresent for young people. This reinforces a sense that they are ‘special’ in undefined ways, affecting expectations, questions, choices, and concerns about the future.”[16]

Working on personal identity not only comes from the parents but also the wider family and young adult experiences. You need to help them understand what wealth means to them, what they do with it, otherwise there is the risk that they will become materialistic and self-destructive. This is achieved by the young person first embarking on a journey to develop a personal sense of purpose and capability. They must have the ability to independently motivate themselves especially when wealth can afford them with so many possibilities.[17]

Jaffe’s research team found that families of wealth manage this by:

Elders letting go and allowing young adults to find their own way with appropriate support for education and travel but not so much that they don’t have to do some things for themselves.

Get first job outside of family business.

Parental expectations should be explicit and don’t give mixed messages that show disapproval of the young person’s choices.

Should resist using money as a means of controlling behaviour.

Family should have a clear agreement about what can be expected from the family and what young people are expected to do in return.

Difficult experiences propel them to learn.

Parental engagement by being in regular contact and supportive, and asking questions rather than preaching or telling the young person what to do.

This does not always means solving a problem or intervening.

Invest in human capital of family members when they show special motivation and ability.

Develop work values.

Develop a plan for personal and career development post college and graduate school.

Make clear what the young person can expect from the family in terms of resources.

From the families studied, Jaffe found philanthropy and social commitments were found to be central to all families globally. They help in developing values and identity in a young person.

It offers a pathway for meaning and engagement. Philanthropy is a way to put their values into action and find a sense of purpose bigger that their own desires and is a great antidote to selfishness as focus is on another person.

Additionally, philanthropic giving provides a concrete opportunity to engage the next generation around social impact, a useful tool to develop stewardship and leadership skills without much scrutiny and with more holistic performance reviews in the business. It also provides an opportunity for a family to work together across generations and branches of the family reinforcing values and social responsibility to build a large family identity beyond business.

Transparency

A concern expressed by many clients, is where parents want to hide the extent of family wealth from their children so as not to create a sense of entitlement and expectation, that would leave little incentive to work hard on their own merit.

The families interviewed by Jaffe’s team found that they encourage transparency. Creating familiarity is education. If discussions are started from a young age, informal training can begin early.

The message of family and individual expectations should be of no surprise if reinforced from a young age and family governance and good stewardship will come naturally to them in adulthood.

The extent to which information and transparency should be provided, thought could be given to:

Will it help or hinder responsible future ownership?

How to inform the rising generation about the family business/enterprise.

How are young and inexperienced family members educated about what is happening?

How are family ideas and input about business policy accessed and listened to?

How can new family members become involved in governance?

Also important, is the professionalisation of family leaders to be responsible stewards whether in a family business or enterprise. Activities that develop “professional” family members include: [18]

Setting clear expectations for consideration of hiring by the business.

Encouraging outside learning (university, business programs).

Requiring candidates to work for a certain number of years for other businesses.

Carefully crafting messages about family hiring for both family and nonfamily staff.

Designing a 'family relationship manager' to support family education and development.

Making evaluation of family transparent and separate from filial lines.

Keeping individuals’ personnel decisions private and professional.

Regularly communicating about how the system is working and willingness to make changes.

Business owners remain the ultimate decision makers, but transparency to other family members can provide alternative perspectives. Eventually family inheritors need to be well informed of the family business or financial situation. Slow and steady is always better than surprise and being ill prepared for transition.

Resilience

Rabbi Daniel Lupin[19] used to get asked all the time why Jewish people are successful in building wealth. A good question considering that throughout history, they’ve been mistreated and persecuted, and despite such setbacks are very successful. “Jews do not constitute even 1/10 of one percent of humans, yet are disproportionately successful in business, not only in the United States but in many countries over many centuries. Jews constitute about 2% of the US population which should be about 8 Jews on the Forbes 400 List, however depending on the year, there are about 60-100 Jews.”[20]

He says “change is constant and the more that things change, the more we need to depend upon those things that never change. War and genocide are not becoming obsolete, and people will always travel and trade. Only the superficialities change.”[21] The things that never change are how Jews have used a set of systemic strategies in the past and continue to do so regardless of their background and dramatic changes in the world. These strategies remain effective.

These strategies are around your perspective which remains unchangeable despite external changes occurring. [22] He says knowing how the world works is ingrained in the Jewish people for generations. With regards to wealth, the timeless truths are literacy, believing in the dignity and morality of business and your connectedness to many people.

Jews are known as the book of the people, not only because of the Bible, but Judaism always expects every Jew to be literate to read the Book. They have a high literacy rate and respect for education. Bookshelves and books are an identifiable feature of a Jewish home and are cherished. Raise highly literate children.

Rabbi Lupin also says that Jews believe in the dignity and morality of business and that the Jewish tradition views a person's quest for profit and wealth to be inherently moral and a blessing as it is an opportunity to serve your fellow human beings. “Jewish people, throughout their often-difficult history, derived real business effectiveness and economic power from possessing a deep conviction about business being an honourable profession. This is what allowed them and indeed spurred them to succeed.”[23]

Jews see the beauty and the nobility in how they earn their living. It is far more than merely seeing yourself as an honest and good person. "You must come to see that part of your goodness, part of the benefit you bring to others is your daily conduct in operating your business enterprise. One must understand the nobility inherent in going to work each day as people seldom excel at any occupation that deep down, they consider unworthy.” [24] He says it injects a vast power into the enterprise undertaken. Feeling virtuous about what you do is an enormous advantage and one that has been part of Jewish tradition since time immemorial. Jewish tradition teaches that equality is neither realistic nor a goal. They accept the view that for some people, enjoying a stress-free existence is more important than hard work and economic success. Equality can never be assured where there is choice of how one wants to live their life. He says thou must provide for yourself first, so that you can help others later and that business is not akin to theft and profit is to plunder.

Another interesting insight from Rabbi Lupin is the power of connectedness to other people. He says one of the reasons many attend synagogue, is to not only worship but afterwards to connect with others. Jewish communal life allows one to build genuine and sincere relationships with no thought of reward. Against all odds and in face of cultural and regulatory difficulties, many Jews in Europe did very well financially and were able to help each other and do business. So, find opportunities to become friendly with many people and don’t hide your occupation. He says that if you stay connected, you’ll be happier. Clearly the opposite of the digital world we currently live in.

Imminent Wealth Transfer About to Take Place Globally.

The UBS Global Family Office Report 2018[25] provides interesting insight on the impending wealth transition approaching within the next 10-15 years which will spur a seismic shift in wealth globally. Established family offices ranked succession planning as their number one governance priority where 43% having a plan already in place with a notable greater need for this to occur in the Asia-Pacific region.

Smooth intergenerational transfer of wealth with limited intrafamily disputes is currently the main priority for high-net-worth families. Some trends around wealth transfer highlighted in the report are as follows:

There has been an accelerated growth in family offices, particularly after 2000. With Singapore seeing a real growth in the number of family offices in recent years.[26]

Location of family offices: 38% Europe, 34% North America, 17% Asia Pacific and 10% emerging markets (South America, Africa, and Middle East). Secondary branches are a trend thus increasing their global footprint.

Older family offices that originated before the 1970’s and who participated in the research, hold a third more AUM on average that those founded after that period, USD$992 million, versus $632 million.

In terms of asset allocation, regionally, most family offices favour a balance approach. Those in Europe tend to be more preservation-orientated than other regions, while those in North America and Asia Pacific claim a growth focused approach.

Investment portfolio for family offices tends to be real estate, equities, and private equities. Hedge funds are now out of favour due to high fees and poor performance.[27]

The next generation are more interested in impact investing as opposed to philanthropy. As of 2018, 38% of family offices participate in sustainable investing, with most invested in thematic investing (clean energy, gender equality, healthcare, water etc) and ESG.

Family governance and succession planning rose to become the largest of all family external professional services costs, with the average family office having spent USD$203k on succession planning within the family professional services category. This figure will be higher as it does not include costs within general advisory services such as trust management. Otherwise from an operational side, they tend to manage things internally to keep costs low.

Global Wealth Distribution 2021

Credit Suisse in its Global Wealth Report 2022[28] found that setting aside exchange rate movements, aggregate global wealth grew by 12.7% with global wealth inequality having fallen this century due to the faster growth achieved in emerging markets. Their five- year outlook is for wealth to continue growing, with the expectation that global wealth to increase by USD 169 trillion by 2026, a cumulative rise of 36%. There has never been a time in history where wealth is in the hands of more than just a few. New wealth may want to take note of how old wealth has managed to keep its wealth for successive generations.

By Failing to Prepare, you are Preparing to Fail.

Successful old wealth families are well organised, prepared for both present and future. They’ve developed structures and policies that enable them to protect capital, withstand geopolitical and economic risk, allocate decision making, and strategize growth. The extent of which undertaken will depend on AUM, sources of wealth, and number of branch families and its members

For families with wealth, they may wish to establish their own family office alongside the family business or independent of it with the purpose of managing the day-to-day family wealth and keeping family governance in house as much as possible, but at the same time recognising that some specialism such as legal, private banking, insurance planning, global custody and integrated investment reporting and tax planning might have to be outsourced.

Within a family office context, the family may be governed by a family constitution and have a family council that rotate on an annual basis so that all family members get involved with decision making. The trust(s) and other entities becomes an active part in managing assets. Where appropriate, a private family trust company may be set up as the trustee for all family members. There could be an investment committee staffed by external investment professionals; and/or a distribution committee staffed by family members to oversee any distributions requested by the family members who are the beneficiaries of the trust.

Successful succession will be where investment has been made in family intangible assets and priority is placed on the education of younger generations, giving them experience where they learn about business operations, investment strategy, asset allocation, succession planning and philanthropy.

Finally, Advice from a Father to His Daughters.

James Beeland Rogers (aka Jim Rogers) is a successful American investor, commentator and writer who belongs to that generation of successful investors, the likes of Jeremy Grantham, Howard Marks, Warren Buffet and Charlie Munger. They’re all new wealth, but have life experience, and more importantly have survived several economic cycles.

Jim had no intention of ever having children and when they did come along, he was 60 years old. He is now 80 years old and it’s apparent that he loves fatherhood. In 2009 he wrote A Gift for My Family with his young daughters in mind who will one day inherit his wealth. The following is a summary of its contents which you may give you some ideas on investing in those family intangible assets.

1. Do Your Own Thinking- Don't let others do it for you.

Other people’s advice is only of use if you first learn everything you can about whatever challenge you are facing. You'll be able to make informed decisions yourself.

Swim your own races, rather than trying to copy others.

You don't have to run with the herd. The most long-term success stories are written by folks who've not done exactly that.

What I want is for both of you to be your true, original, unique selves. No one ever became a standout success by imitating others.

No matter what the age, I say do what you want, if you use your own judgment to determine what is right ethically.

While you need to concern yourself with conventional wisdom and other so- called established notions, you must respect and follow the rules, laws and ethical practises without which society cannot exist.

You must avoid the trap of spending money willy-nilly simply because you can. Not only is this a road to financial ruin, but it can also cause you to forget what's important in life.

Age is irrelevant when you are passionate about a goal.

Dedicate yourself to what you feel passionate about. Always start with something that interests you and that you truly enjoy. You are more likely to become successful if you do what you love.

2. Good habits for Life and Investing

Be a self-starter.

Have a strong work ethic, opportunities will open because of them.

Attention to details is what separates success from failure. If you love and care about what you do, you'll naturally want to do it the best you can. In investing, as in life, the small details often spell the difference between success and failure. Be attentive.

No matter how trivial it may seem, you must research and check each piece of information you need to decide on.

Do thorough research, failure in part occurs due to faulty research or limited to what is available. Through meticulous research you will obtain the knowledge necessary for success. Such effort will give you a distinct advantage over your competitors.

3. Common Sense? Not So Common

Conventional wisdom - accepted "truths" about how to behave, or what to study, or eat or how to invest. You must never blindly accept what you hear or read, no matter how many people believe it or how strongly they advocate it. Always consider alternative interpretations.

Popular beliefs embraced by the larger society are often mistaken. Use common sense.

Read media publications daily, but approach with healthy scepticism. Take advantage of inaccuracies.

4. Your Education, Part I: Let the World Be Part of Your Perspective.

People are basically the same no matter what they look like and that you'll discover more about yourself as you encounter and experience the world’s diversity.

See the world from the ground up. Difficult economic times often give birth to dangerous policies.

Remember that history rhymes and be attentive; economic problems and war have recurred throughout history, so prepare yourself in case these tendencies persist. You may have to move to neutral countries while making investments that could benefit from turmoil, such as real assets and freely convertible currencies.

Keeping an open mind includes never closing yourself to the possibility that people are different from what you first imagine. There's a difference between knowing a type of person and knowing a person.

When you travel the world, you realise and come to understand that very few human beings conform to the stereotypes imposed upon them. And for the most part, we all want the same things.

5. Your Education, Part II: Learn Philosophy; Learn to Think

Learn to think at a profound level if you want to understand yourself and what's important to you.

You must know yourself if you want to accomplish anything in life. Studying philosophy has helped me do just this. The simple art of thinking for yourself.

So many folks today are caught up in conventional thinking, their intellectual processes circumscribed by such concepts as the state, culture, or religion. Studying philosophy trains a person to examine things independently.

6. Your Education, Part III: Learn History!

Understand how the world works from a macroscopic perspective. Understand how the world works and has always worked.

An interest in history, politics, and economics will help you see how occurrences in one country affect other nations.

By cross referencing historical events with long term trends in the market, you will identify those developments that affect stock and commodity prices.

What is happening now has happened before and will happen again.

7. Your Education, Part IV: Learn Languages (and Make Sure That Mandarin Is One of Them!)

Learn another language, it's easier to do business with them.

Pay attention to the major changes taking place in the world now not only as an investor but also as a world citizen.

8. It Is the Century of China

Pay attention to the major changes taking place in the world now not only as an investor but also as a world citizen.

9. Know Thyself by Understanding Your Weaknesses and Acknowledging Your Mistakes

Know who you are. Know what drives you, you’re most likely to be able to ride any crises.

Observe how you react to mistakes, so that you can respond more constructively the next time things go wrong.

Try and not be carried away from mob psychology.

To be a successful investor, you need to understand psychology as well as history and philosophy. Very often emotions drive the market up or down. Economies and stock market are two different things.

Losing your perspective during market panic is equivalent to losing your money in the market.

10. Recognise Change and Embrace It.

For a bargain to soar in price, there must be a catalyst is change. Whatever the change may be, it must have a significant impact within a country or an industry, and it must also be recognised as significant externally within a few years. If the change is real, others will notice the improvement, and prices will rise to reflect the new circumstances. New investors will catch on and prices can rise considerably for years.

Those who cannot adjust to change will be swept aside by it. Those who recognise change and react accordingly will benefit.

11. Look To the Future

People who can observe events as they unfold will acquire wealth -read the news.

Keep your eye on the future. Do not cling to anything that will eventually cease to exist.

Pay attention to what everybody else neglects.

Be quick to start something new, something that no one else has tried. If you want to invest, look for the bear market. Many have frequently profited by investing where no one else saw potential. You can be rich if you have the courage to buy something while it is still under the radar of conventional wisdom.

Never act on wishful thinking.

Act without checking the facts, and chances are that you will be swept away along with the mob. Whenever you see people acting in the same way, it is time to investigate supply and demand objectively.

12. On Effort

Once you take that first step toward your dream, put your full effort into it.

Do your homework. My most successful investments were those in which I invested the most time and hard work, collecting all available information and researching every detail. Likewise, if you are merely dabbling in an area, you are gambling, not investing.

You must know what you are dealing with if you want to be successful.

Concluding Thoughts

Successful wealth succession and protection comprise many parts. Each family and its wealth are unique and requires tailored solutions, thoughtful consideration, and discussion with trusted advisors. However, unless investment is made of family intangible assets, there will be no framework for navigating the decades ahead.

[1] A portion from the limited ad campaign found in selected publications such as the Wall Street Journal featured in The Big Man of Jim Beam Booker Noe and the Number One Bourdon in the World by Jim Kokoris.

[2] Family Business and It’s Longevity, Toshio Goto, Japan University of Economics, Japan, Kindi Management Review Vol 2, 2014 (ISSN: 2186-6961)

[3] P156 The Rothschild A Family Portrait by Frederic Morton

[4] Ibid 26

[5] Ibid p 184

[6] Ibid p324

[7] p188 Dynasties by David Landes

[8] Ibid 186-188

[9] Dynasties by David S Landes

[10]P47 Borrowed From Your Grandchildren The Evolution of 100-Year Family Enterprises by Dennis T. Jaffe

[11] Ibid p37

[12] Ibid p44

[13] Credit Suisse Research Institute the CS Family 1000 in 2018

[14] p295 Borrowed from Your Grandchildren the Evolution of 100-Year Family Enterprises by Dennis T. Jaffe

[15] Ibid pg 121-123

[16] Ibid 297

[17] Ibid p297

[18] Ibid pg 141

[19] Thou Shall Prosper Ten Commandments for Making Money by Rabbi Daniel Lupin.

[20] Ibid p74

[21] Ibid pg 24

[22] The same was said by Viktor Frankl holocaust survivor in his book Mans’s Search for Meaning.

[23] Ibid p74

[24] Ibid P81

[25] UBS, Credit Suisse and EY publish reports annually on family wealth which provides insights on current themes or trends.

[26] Most likely due to favourable tax position offered by that country.

[27] The 2022 USB Global Family Office Report state similar findings.

[28] Credit Suisse Global Wealth Report 2022